A cura di Jon Seed, Alpha Architect

U.S. Companies bought back $217 Billion of their $1.3bn in overseas cash in the first quarter helping fuel a record $189 billion in stock buybacks. More are expected throughout the year. Even Warren Buffett is getting deeper into the game. Has this demand pushed up stock prices, perhaps for the benefit of management over long-term shareholders who would have preferred reinvestment?

I will argue “no,” at least in theory. I will also show the evidence that I could be wrong. My larger point is that despite this tension, theory and contradictory evidence can co-exist and can still reveal truths. For stock buybacks, this truth includes their effect on common measurements of valuation, themselves simplified models of reality. Those investors who stay humble yet curious, skeptical and adaptable, can thus stay unperturbed by all the recent rhetoric around stock buybacks.

The Basics of Stock Buyback in Theory

I will start by illustrating that buybacks by themselves don’t theoretically change the value of firms. This insight on the irrelevance of the capital structure to a firm’s value was behind the Nobel Prize in Economics awards given to both Franco Modigliani and Merton Miller. It is known as the Modigliani-Miller theorem.

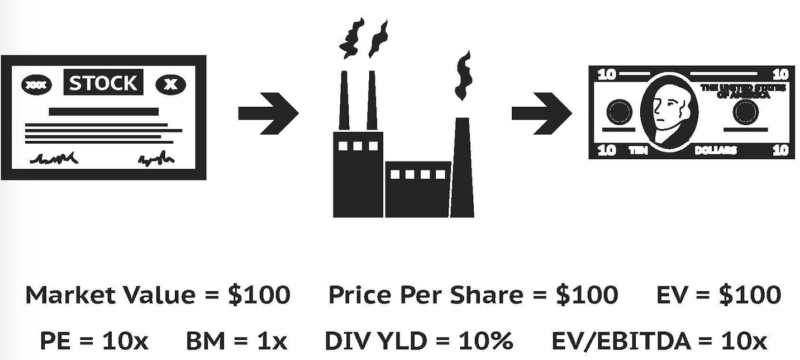

As is true when building any model, I need to start by simplifying my world and do so by making some very unrealistic assumptions: zero interest rates for both cash and borrowing rates, no taxes or transactions costs and perfect price inelasticity (i.e., prices and thus profits won’t change with supply). In my fantasy world, I have one company with one factory that issues one share of stock that the market values at $100. This fantasy firm generates an expected $10 in profits annually which it pays out as dividends and is expected to do so into perpetuity. If that’s not enough, its factory never depreciates.

The capital structure picture: one share of stock worth $100 which owns one company with one factory which entitles the shareholder to receive $10 into perpetuity.

Simple One Share Co

The resulting valuations measures:

- The Price-to-Earnings ratio (or price per share/earnings per share referred to as PE) = $100/$10 or 10X.

- The Book-to-Market Value (or book value/market value referred to as BM) = $100/$100 or 1X.

- The Dividend Yield (or dividend per share/price per share referred to as Div Yld) = $10/$100 or 10%. Because in our case all earnings are paid out as dividends and last into perpetuity, this is also our discount rate.

- The Total Enterprise Value (or Market Value plus Debt minus Cash referred to as EV) to Cash Flow (or Earnings before Interest, Taxes, Depreciation and Amortization referred to as EBITDA), the resulting ratio referred to as EV/EBITDA = $100/$10 since we assumed away the ITDA or 10X.

Now, let’s view the impact of playing with the capital structure of our fantasy firm. First, let’s issue another share and sit on the cash (i.e., do the opposite of a stock buyback).

Continua a leggere su Alpha Architect