A cura di Jack Forehand, Validea Capital Management

Alpha has always been elusive in the stock market. Stock pickers have tried to produce it since the market has existed, but in aggregate they have been largely unsuccessful. Almost any long-term study that has been done has shown that managers who consistently produce alpha are few and far between.

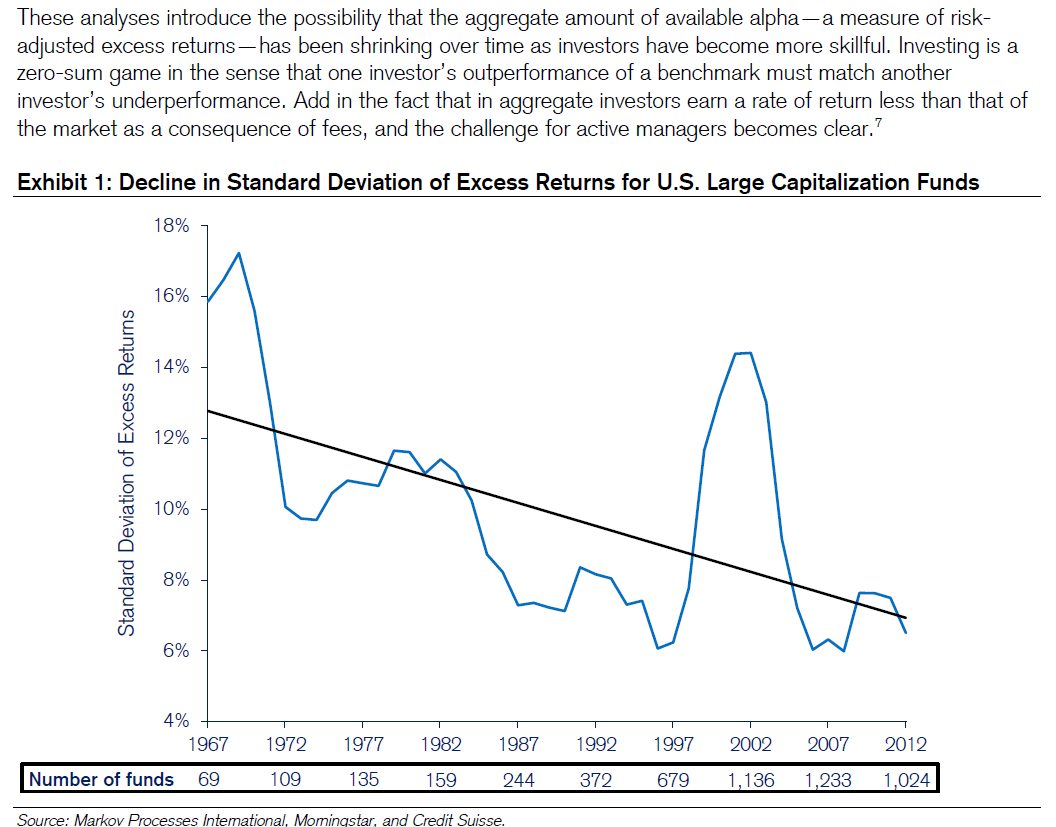

In recent times, things have been getting even tougher. When the skill of managers rises and the tools available to them improve, the level of competition rises, and the ability to successfully create alpha for any individual manager falls. It is tough to argue that both of those haven’t happened in the past decade.

In 2013, Michael Mauboussin authored a piece for Credit Suisse titled, “Alpha and the Paradox of Skill“. In the paper, he wrote and showed the following:

Source: Alpha and the Paradox of Skill

I came across an interesting thread started by Ben Hunt from Epsilon Theory recently on Twitter and it got me thinking about what creates alpha and how that impacts the ability of managers to generate it in today’s market.

This is the tweet the started the discussion.

What Ben is saying is that if you want alpha, you need information that no one else has. If that is true, it has significant implications for not just factor investing, but for active management in general.

But is it true? Before we get to that, let’s take a step back and talk about what alpha is because the term in used improperly much of the time.

The Difference Between Alpha and Outperformance

Continua a leggere sul sito di Validea